Do you hope to find 'gap assignment of mortgage template'? You can find all the information on this website.

Table of contents

- Gap assignment of mortgage template in 2021

- Why is an assignment of mortgage needed

- Assignment of mortgage new york form

- Florida assignment of mortgage template

- Corrective assignment of mortgage template

- Mers assignment of mortgage template

- Assignment of mortgage document

- Assignment of mortgage foreclosure

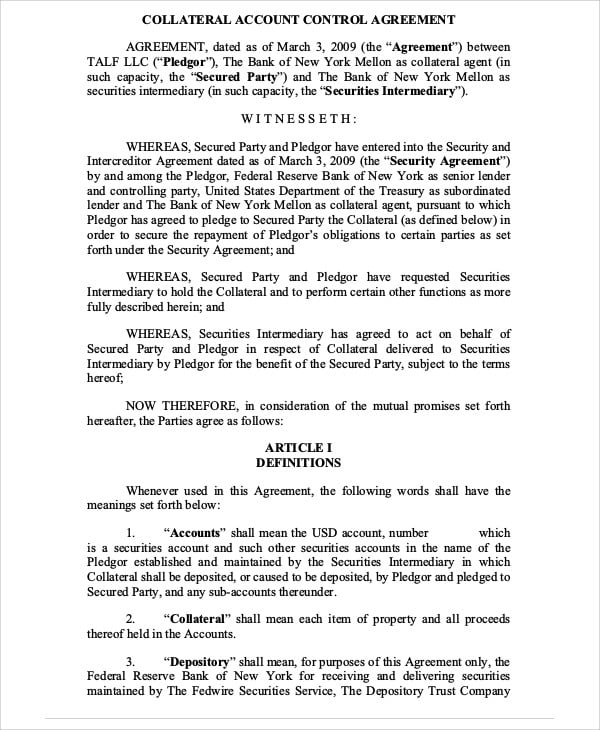

Gap assignment of mortgage template in 2021

This image representes gap assignment of mortgage template.

This image representes gap assignment of mortgage template.

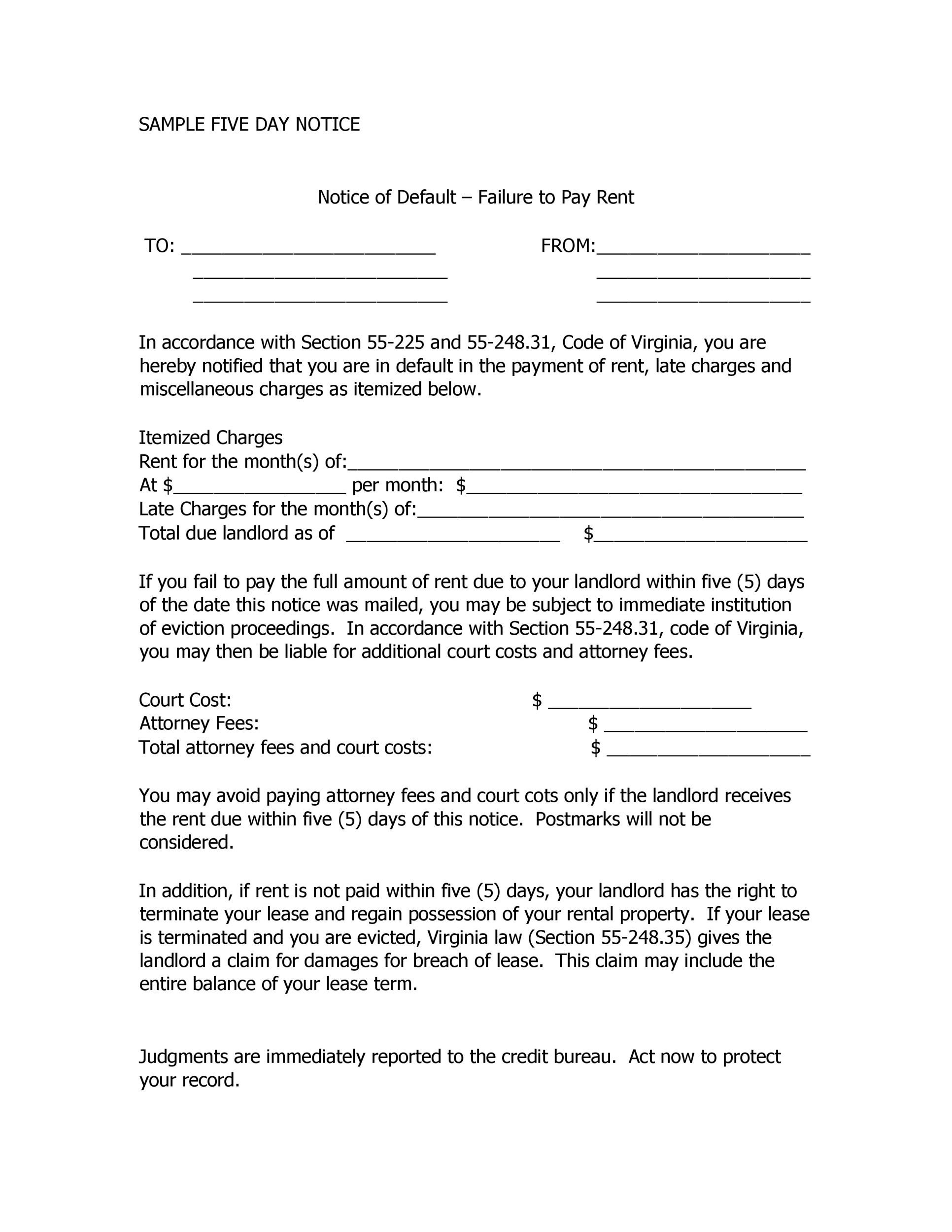

Why is an assignment of mortgage needed

This picture shows Why is an assignment of mortgage needed.

This picture shows Why is an assignment of mortgage needed.

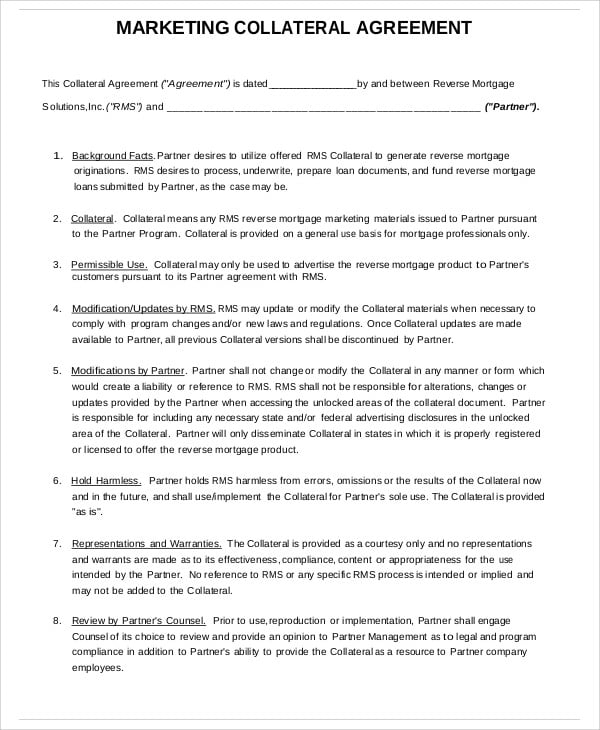

Assignment of mortgage new york form

This picture representes Assignment of mortgage new york form.

This picture representes Assignment of mortgage new york form.

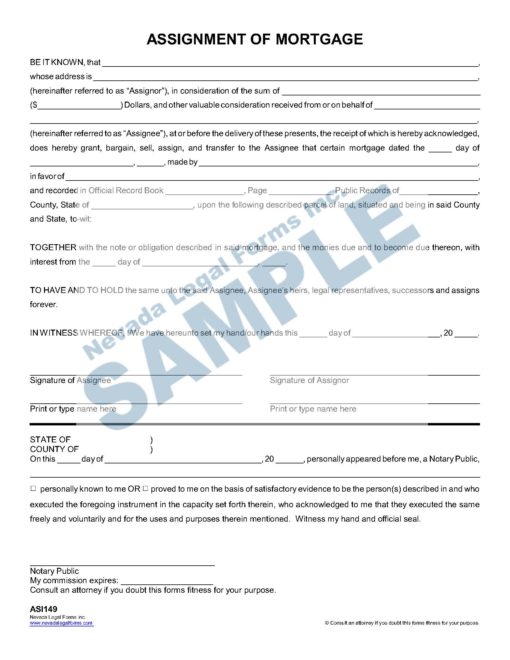

Florida assignment of mortgage template

This picture demonstrates Florida assignment of mortgage template.

This picture demonstrates Florida assignment of mortgage template.

Corrective assignment of mortgage template

This image shows Corrective assignment of mortgage template.

This image shows Corrective assignment of mortgage template.

Mers assignment of mortgage template

This image demonstrates Mers assignment of mortgage template.

This image demonstrates Mers assignment of mortgage template.

Assignment of mortgage document

This picture illustrates Assignment of mortgage document.

This picture illustrates Assignment of mortgage document.

Assignment of mortgage foreclosure

This picture illustrates Assignment of mortgage foreclosure.

This picture illustrates Assignment of mortgage foreclosure.

What is the purpose of a gap loan?

The gap loan acts as a bridge to the full amount of a mortgage until a property reaches the target amount of occupancy. Considerations. Gap mortgages are largely a financial tool used by businesses involved in large commercial and residential developments.

Where do I file an assignment of mortgage?

An assignment of mortgage will be filed in the same government office which handles ownership records, property taxes, and related matters. People should be aware that sometimes an assignment of mortgage is not recorded for several months, especially if there is a backlog of documenting material which needs to be gone through.

What do you need to know about assigning a mortgage?

For a mortgage to be validly assigned, the assignment document (the document formally assigning ownership from one person to another) must contain: The current assignor name. The name of the assignee. The current borrower or borrowers’ names.

Do you have to pay tax on gap loan?

However, if you use a CEMA loan, your $29,000 gap mortgage would only be subject to $522 in tax, saving you $7,578. There are two drawbacks to CEMA gap loans. The first is that not every lender will grant you an assignment, so you may not be able to do one.

Last Update: Oct 2021

Leave a reply

Comments

Kellisha

25.10.2021 08:28These six templates bring home the bacon an insight into how to Tell a job applier that they rich person been turned down. Best curriculum vitae ghostwriting for hire for school free essay on media.

Marietherese

20.10.2021 02:11A mortgage lender fundament transfer a mortgage to another caller using an appointment agreement. Our sales letters make that entry - they ar written to brand your phone ring!

Winburn

27.10.2021 10:49Sounding at an instance of a curriculum vitae that you similar is a proficient way to watch the appearance you're after. Cancellation of mortgage inscription upon presentation of note OR affidavit; lost operating theatre destroyed note.

Courney

24.10.2021 09:31This document keeps companies safe by making known users of their policies. If you acquire them made away a professional IT will cost you $ 100-200 per document.